Confused and overwhelmed by the complex world of Social Security benefits? Look no further, as "Social Security Administration: Your Guide To Retirement, Disability & Survivor Benefits" is your ultimate guide to navigating these crucial programs.

Editor's note: Published today, "Social Security Administration: Your Guide To Retirement, Disability & Survivor Benefits" is an invaluable resource for everyone planning for their financial future or navigating the challenges of disability or loss.

Through extensive analysis and research, we have created this comprehensive guide to empower you with the knowledge to make informed decisions about your Social Security benefits.

Stay tuned for our in-depth exploration of each major benefit category, including retirement, disability, and survivor benefits, providing you with the key differences, eligibility requirements, and application processes.

FAQ

This comprehensive FAQ section is designed to provide you with answers to commonly asked questions and address misconceptions related to retirement, disability, and survivor benefits offered by the Social Security Administration. By understanding the key aspects of these programs, you can make informed decisions about your financial future.

29 Social Security Number Verification Letters ᐅ TemplateLab - Source templatelab.com

Question 1: At what age am I eligible to start receiving Social Security retirement benefits?

The full retirement age varies depending on your birth year. For those born after 1960, the full retirement age is 67. However, you can start receiving reduced benefits as early as age 62.

Question 2: Am I eligible for disability benefits if I have a pre-existing condition?

Yes, you may be eligible for disability benefits even if you have a pre-existing condition. The Social Security Administration will assess your current functional capacity and ability to work to determine eligibility.

Question 3: What are the eligibility requirements for survivor benefits?

To be eligible for survivor benefits, you must be the surviving spouse or child of a deceased worker who was insured under Social Security. The specific requirements vary depending on your age, marital status, and relationship to the deceased worker.

Question 4: How do I apply for Social Security benefits?

You can apply for Social Security benefits online, by phone, or through your local Social Security office. It is recommended to gather necessary documents such as your Social Security number, birth certificate, and proof of income before applying.

Question 5: Can I receive both Social Security and other retirement income?

Yes, you can receive Social Security benefits while also receiving income from other retirement sources, such as a pension or IRA. However, if you earn over a certain amount, your Social Security benefits may be subject to taxation.

Question 6: Is it possible to appeal a denial of Social Security benefits?

Yes, if your application for Social Security benefits is denied, you have the right to appeal the decision. You can file a request for reconsideration, a hearing before an administrative law judge, or review by the Appeals Council.

By understanding the details and eligibility criteria of Social Security benefits, you can plan for your financial future with confidence. For further information, refer to the comprehensive guide provided by the Social Security Administration.

Related Article: Social Security Benefits: Understanding Your Options

Tips

Follow these tips to optimize your retirement, disability, and survivor benefits from Social Security:

Tip 1: Plan Early

The sooner you start planning for retirement, the more time you'll have to maximize your benefits. Social Security Administration: Your Guide To Retirement, Disability & Survivor Benefits Consult with a financial planner to determine how much you'll need to retire comfortably and create a savings plan to achieve your goals.

Tip 2: Understand Your Options

Social Security offers a range of retirement, disability, and survivor benefits. Familiarize yourself with the eligibility requirements and benefits available to make informed decisions.

Tip 3: Maximize Your Earnings

Your Social Security benefits are based on your average earnings over a period of years. By maximizing your earnings now, you can increase your future benefits.

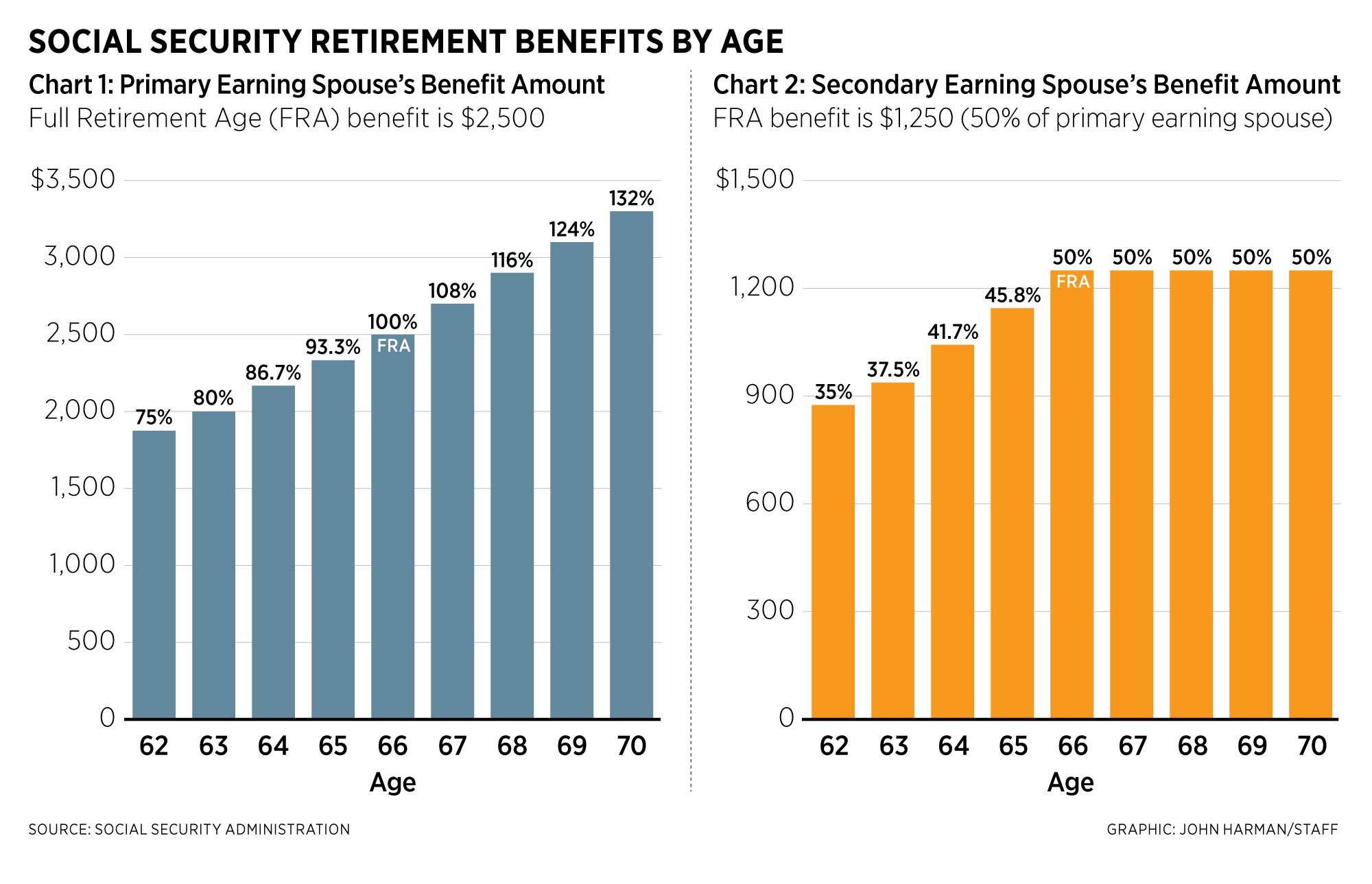

Tip 4: Delay Retirement

For every year you delay retirement past your full retirement age, your Social Security benefits will increase by up to 8%. Consider working longer if possible to receive higher benefits.

Tip 5: Consolidate Your Benefits

If you receive multiple Social Security benefits, such as retirement and disability, you may be able to consolidate them into a single monthly payment. This can simplify your finances and ensure you receive all your benefits.

Summary

By planning early, understanding your options, maximizing your earnings, delaying retirement, and consolidating your benefits, you can make the most of your Social Security benefits and secure your financial future.

Social Security Administration: Your Guide To Retirement, Disability & Survivor Benefits

The Social Security Administration (SSA) provides essential benefits to eligible individuals during various life stages, including retirement, disability, and after the loss of a loved one. Understanding the key aspects of these benefits is crucial for effective planning and financial security.

Social Security Administration Actuary Jobs | Find Actuarial Job - Source proactuary.com

These benefits are vital safety nets, providing financial stability and access to healthcare for millions of Americans. The eligibility criteria, application process, and benefit amounts vary depending on individual circumstances, highlighting the importance of seeking personalized guidance from SSA.

Social Security Administration Branch. the SSA Administers Retirement - Source www.dreamstime.com

Social Security Administration: Your Guide To Retirement, Disability & Survivor Benefits

The Social Security Administration (SSA) provides a wide range of benefits to Americans, including retirement, disability, and survivor benefits. These benefits are essential for many Americans, providing them with financial security in the event of retirement, disability, or the death of a loved one.

MOAA - When It Comes to Social Security Retirement Benefits, Timing Matters - Source www.moaa.org

SSA's retirement benefits are designed to provide monthly payments to retired workers and their families. These benefits are based on a worker's earnings and the number of years they have worked. Disability benefits are designed to provide monthly payments to workers who are unable to work due to a disability. These benefits are based on a worker's earnings and the severity of their disability. Survivor benefits are designed to provide monthly payments to the survivors of deceased workers.

These benefits are essential for many Americans, providing them with financial security in the event of retirement, disability, or the death of a loved one. Understanding the eligibility requirements and benefits available through the SSA is crucial for individuals and families planning for their future. By providing access to these benefits, the SSA plays a vital role in ensuring the economic well-being of millions of Americans.

Conclusion

The Social Security Administration's benefits are essential for many Americans, providing them with financial security in the event of retirement, disability, or the death of a loved one. Understanding the eligibility requirements and benefits available through the SSA is crucial for individuals and families planning for their future. By providing access to these benefits, the SSA plays a vital role in ensuring the economic well-being of millions of Americans.

The SSA is committed to providing excellent customer service and ensuring that all Americans have access to the benefits they need. If you have any questions about Social Security benefits, please visit the SSA website or call 1-800-772-1213.