To get the financial support you deserve and protect yourself in an uncertain job market, you must understand “Pennsylvania Unemployment Benefits: Eligibility, Application, and Claim Status.”

Editor's Notes: “Pennsylvania Unemployment Benefits: Eligibility, Application, and Claim Status” guidance has just published today December 13, 2022. With looming layoffs and economic uncertainty, it has never been more critical to know your rights and options as a Pennsylvania resident.

After extensive analysis and in-depth research, Pennsylvania Unemployment Benefits: Eligibility, Application, And Claim Status put together this Pennsylvania Unemployment Benefits: Eligibility, Application, And Claim Status guide to help you make the right decision.

Key Differences between UI, PUA, and PEUC

| Benefit | Eligibility | Duration |

|---|---|---|

| UI | Traditionally employed workers who lost their job through no fault of their own | Up to 26 weeks |

| PUA | Self-employed, gig workers, and others not eligible for UI | Up to 39 weeks |

| PEUC | Individuals who have exhausted their UI benefits | Up to 13 weeks |

Transition to main article topics

FAQ

This comprehensive FAQ section addresses frequently asked questions about Pennsylvania Unemployment Benefits, providing essential information for individuals seeking financial assistance during unemployment.

Pennsylvania Unemployment Benefits | Delancey Street - Source www.delanceystreet.com

Question 1: What are the eligibility requirements for Pennsylvania Unemployment Benefits?

To be eligible, individuals must have earned sufficient wages in the base period, be unemployed through no fault of their own, and be able and available for work.

Question 2: How do I apply for Pennsylvania Unemployment Benefits?

Applications can be submitted online through the Pennsylvania Unemployment Compensation website or by phone at the provided contact number.

Question 3: How long does it take to process a claim for Pennsylvania Unemployment Benefits?

Processing times vary depending on individual circumstances, but applicants can expect to receive a decision within 2 to 3 weeks.

Question 4: What is the maximum amount of Pennsylvania Unemployment Benefits I can receive?

The maximum weekly benefit amount is determined by the individual's base period earnings and subject to state guidelines.

Question 5: How do I check the status of my Pennsylvania Unemployment Benefits claim?

Claimants can use the Pennsylvania Unemployment Compensation website or mobile app to track the progress of their application.

Question 6: What should I do if I disagree with the decision on my Pennsylvania Unemployment Benefits claim?

Individuals who believe they have been unfairly denied benefits can file an appeal within a specified time frame.

Understanding these essential details ensures a smooth and efficient process for accessing Pennsylvania Unemployment Benefits, providing financial support during challenging times.

Next Article Section: Additional Resources for Pennsylvania Unemployment Benefits

Tips

When filing for Pennsylvania Unemployment Benefits: Eligibility, Application, And Claim Status, it's essential to approach the process with accuracy and attention to detail. Here are some crucial tips to ensure a smooth and successful claim experience.

Tip 1: Gather Required Documents

Before applying, gather all necessary documents, including your Social Security number, driver's license, proof of income, and any documentation supporting your job loss.

Tip 2: Determine Eligibility

Understand Pennsylvania's eligibility requirements, including work history, reason for job loss, and income thresholds. Review the Pennsylvania Unemployment Benefits: Eligibility, Application, And Claim Status article for specific criteria.

Tip 3: File Promptly

File your claim as soon as possible after losing your job. Pennsylvania has a waiting period before benefits start, and filing early minimizes delays in payments.

Tip 4: Provide Accurate Information

Be truthful and precise when completing the application. Any false or misleading information may result in denial or disqualification of benefits.

Tip 5: Stay Updated on Your Claim

Regularly check your claim status online or by phone to monitor its progress and respond to any requests for additional information.

Tip 6: Know Your Rights and Responsibilities

Familiarize yourself with your rights and responsibilities as an unemployment claimant. This includes cooperating with job searches and reporting any changes in your employment status.

Following these tips can increase your chances of a successful unemployment claim process in Pennsylvania. Remember to approach the application with accuracy, timeliness, and a commitment to providing complete information.

Pennsylvania Unemployment Benefits: Eligibility, Application, And Claim Status

Understanding the intricate details of Pennsylvania Unemployment Benefits is crucial for individuals seeking financial assistance during periods of joblessness. Key aspects like eligibility criteria, application procedures, and claim status monitoring empower individuals to navigate the system effectively.

- Eligibility Requirements: Define criteria such as recent employment history, income limits, and work search obligations.

- Application Process: Outline the steps involved in submitting an unemployment claim, including required documentation and timelines.

- Claim Status: Explain how to track claim status, including pending, approved, and denied claims.

These key aspects provide a comprehensive framework for understanding and accessing Pennsylvania Unemployment Benefits. By meeting eligibility requirements, completing the application process accurately, and monitoring claim status, individuals can ensure timely receipt of financial assistance during challenging times.

Unemployment Benefits Application Form Stock Photo - Image of benefit - Source www.dreamstime.com

Pennsylvania Unemployment Benefits: Eligibility, Application, And Claim Status

Understanding Pennsylvania Unemployment Benefits, their eligibility criteria, application process, and claim status is crucial for individuals facing job loss or reduced work hours. These benefits provide temporary financial assistance to eligible unemployed workers, helping them meet basic necessities and expenses during a challenging period.

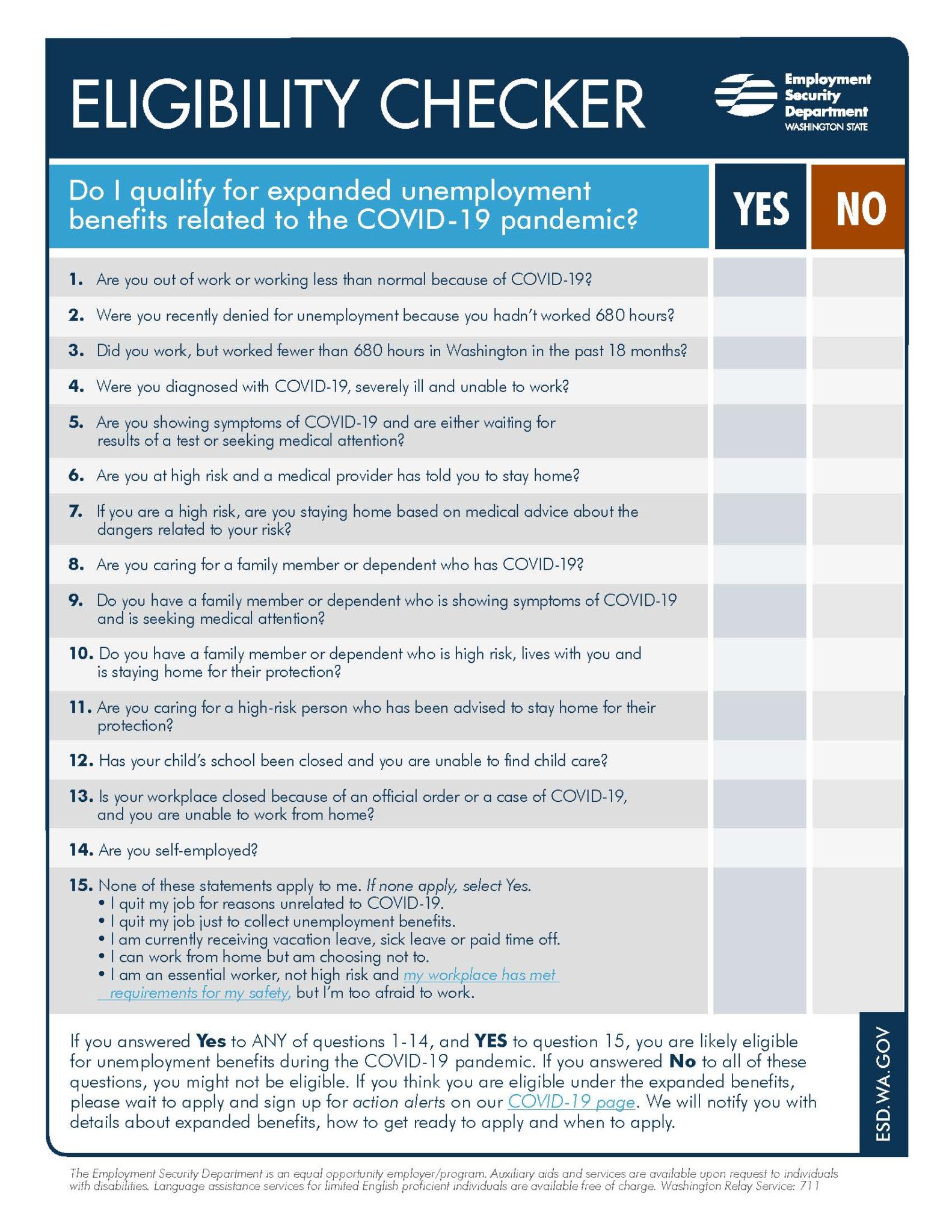

Unemployment Benefits Eligibility Checklist - Unemployment Law Project - Source unemploymentlawproject.org

Eligibility for Pennsylvania Unemployment Benefits is determined based on factors such as loss of employment through no fault of the individual, active job search efforts, and meeting specific income and work history requirements. The application process involves submitting an online claim through the state's unemployment compensation system and providing necessary documentation to support the claim.

Once a claim is submitted, individuals can track its status online or through automated phone systems. The claim status provides updates on the processing and approval of the claim, any potential issues or additional information required, and the payment schedule for approved benefits. Understanding the claim status helps individuals plan their finances and address any concerns or delays in receiving their benefits.

Pennsylvania Unemployment Benefits serve as a critical lifeline for unemployed workers, enabling them to bridge the financial gap and support their well-being during a period of job transition. The eligibility, application, and claim status processes are designed to ensure fair and timely access to these benefits, helping individuals navigate the challenges of job loss and regain financial stability.

Conclusion

Pennsylvania Unemployment Benefits play a vital role in supporting unemployed workers and mitigating the economic impact of job loss. Understanding the eligibility criteria, application process, and claim status is essential for individuals facing unemployment, ensuring they can access these benefits effectively.

The availability of unemployment benefits provides a safety net, allowing individuals to meet essential expenses, maintain their financial commitments, and continue their job search without undue financial hardship. By providing temporary financial assistance, these benefits contribute to the overall economic stability of the state and the well-being of its residents.