VIX: The Fear Index Explained And How To Trade It

Editor's Notes: "VIX: The Fear Index Explained And How To Trade It" was last published on [--- --, 2023] and is a very important subject we continue to see more and more day to day. We analyze and dig into tons of information and data every day so we put together this VIX: The Fear Index Explained And How To Trade It guide to help you make the right decision.

Key differences or Key takeways, provide in informative table format

Transition to main article topics

Vix Volatility Index Fear Index On Stock Illustration 2202135889 - Source www.shutterstock.com

FAQ

This section addresses frequently asked questions about VIX, the Volatility Index, to enhance your understanding and assist in effective trading.

VIX: "Fear Gauge" Or "Love Gauge" (VIX) | Seeking Alpha - Source seekingalpha.com

Question 1: What is the VIX and how is it calculated?

The VIX is a real-time market index that measures the implied volatility of S&P 500 options over the next 30 days. It is derived from the prices of out-of-the-money (OTM) call and put options with varying strike prices and expirations.

Question 2: What does a high VIX value indicate?

A high VIX value, typically above 20, suggests elevated market volatility and investor fear. It can be interpreted as a sign of increased uncertainty and heightened risk aversion, often associated with market downturns or periods of economic instability.

Question 3: What does a low VIX value indicate?

A low VIX value, typically below 15, indicates lower market volatility and investor complacency. It suggests a market environment perceived as less risky and more stable, often associated with market upswings or periods of economic stability.

Question 4: How can I use the VIX to trade?

The VIX can be used as a tool for volatility trading, enabling investors to hedge against market fluctuations or speculate on market movements. For instance, traders can buy VIX futures or options when they anticipate increased volatility, or sell them when they expect volatility to decline.

Question 5: What are the limitations and risks of trading the VIX?

While the VIX provides valuable insights into market sentiment, it is essential to be aware of its limitations and potential risks. The VIX is a forward-looking index that cannot perfectly predict future volatility, and historical patterns may not always be reliable indicators.

Question 6: What other factors besides the VIX can influence market volatility?

Various economic and geopolitical factors can impact market volatility, including interest rate changes, economic data releases, geopolitical events, and natural disasters. Monitoring these broader market dynamics is crucial for making informed trading decisions.

By understanding the VIX and its implications, investors can navigate market volatility more effectively, make informed trading decisions, and enhance their overall financial strategies.

Proceed to the next article section...

Tips

To effectively trade VIX, consider the following tips:

Tip 1: Understand VIX's nature and drivers

VIX is a measure of market volatility and is not directly tradable. It is calculated from the prices of S&P 500 index options and reflects investors' expectations of future volatility. Understanding the factors that drive VIX's movements, such as economic data, geopolitical events, and market sentiment, is crucial.

Tip 2: Use VIX as a contrarian indicator

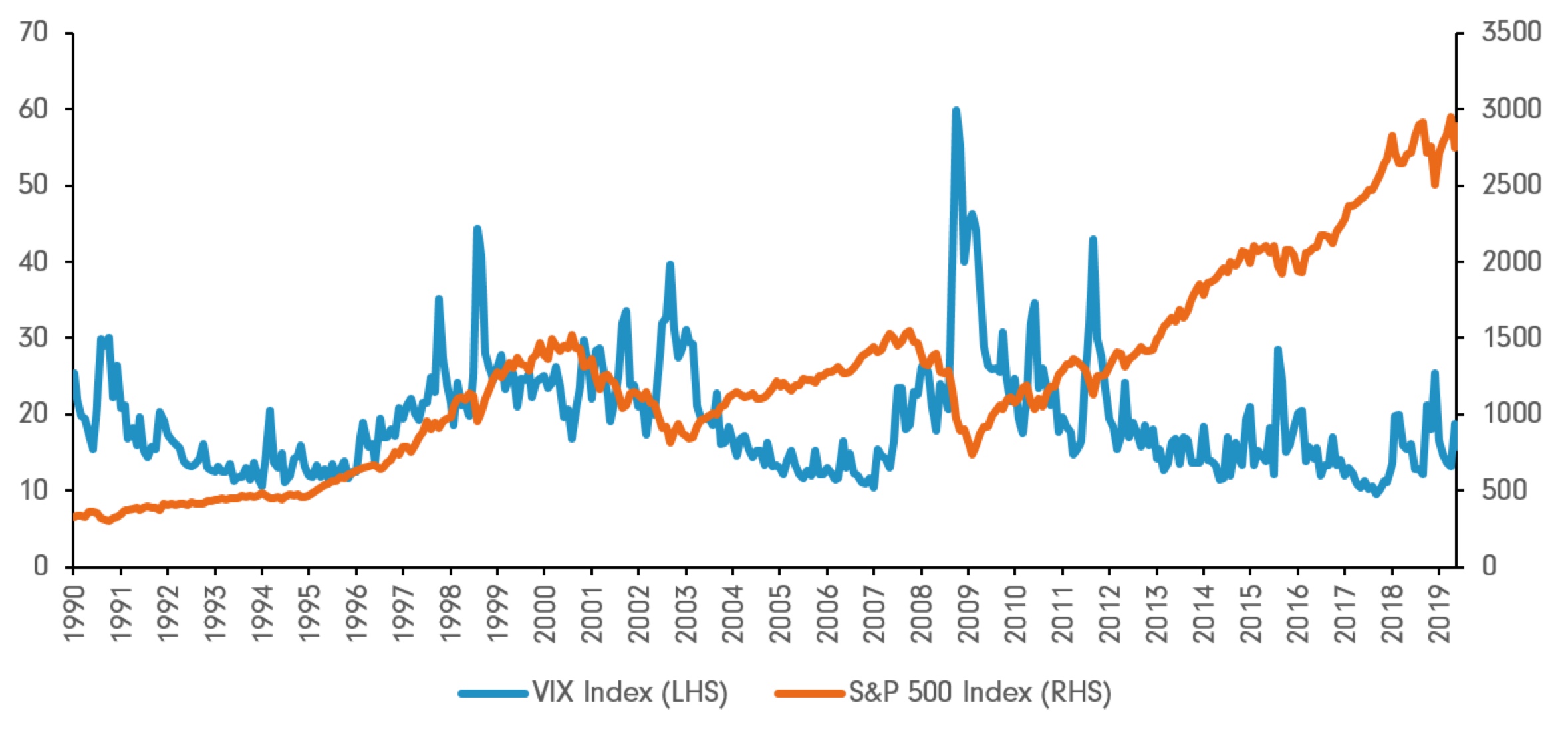

VIX tends to move inversely to the S&P 500 index. When VIX is high, it suggests fear and uncertainty in the market, often indicating a potential opportunity to buy stocks at a discount. Conversely, low VIX levels may signal complacency and a potential time to reduce exposure to equities.

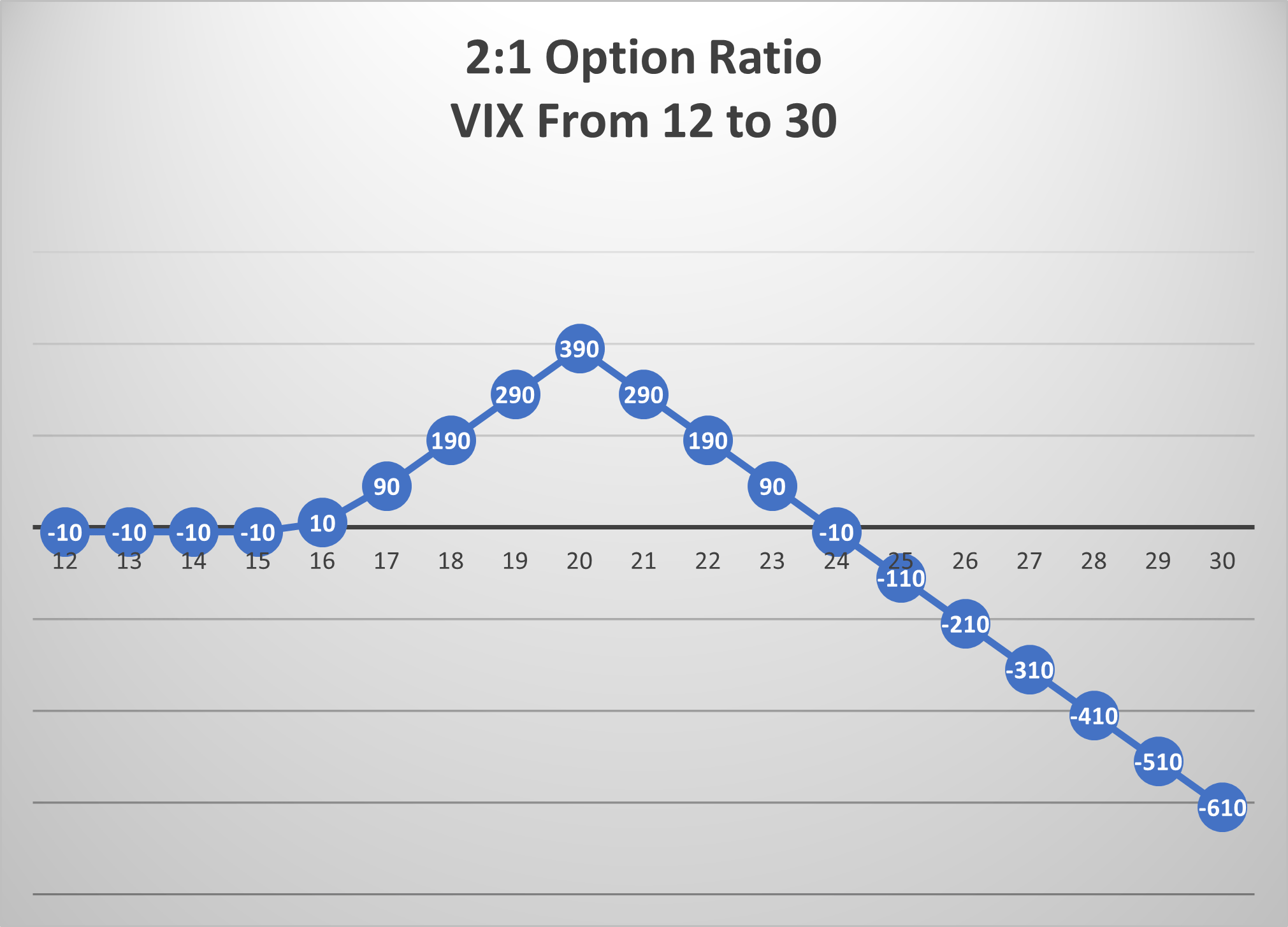

Tip 3: Consider using VIX futures or options

While VIX itself is not tradable, you can trade futures and options contracts based on VIX. VIX futures allow you to speculate on future VIX levels, while VIX options provide more flexibility and tailored risk exposure.

Tip 4: Manage risk carefully

Trading VIX can be volatile and requires careful risk management. Determine your tolerance for risk and trade within your limits. Set stop-loss orders to limit potential losses and consider using options strategies to manage risk.

Tip 5: Stay informed about market news and events

VIX is highly influenced by market news and events. Stay informed about economic data releases, geopolitical events, and earnings reports that can impact VIX's movements. Monitor news sources and economic calendars to stay ahead of potential market shifts.

By following these tips, you can increase your understanding of VIX and improve your ability to trade it effectively. Remember to approach VIX trading with caution and manage risk appropriately.

For more insights, refer to the comprehensive article on VIX: The Fear Index Explained And How To Trade It.

VIX: The Fear Index Explained And How To Trade It

The Cboe Volatility Index (VIX), widely known as the "fear index", plays a crucial role in the financial market, reflecting the implied volatility of the S&P 500 Index options. Understanding and trading the VIX can provide valuable insights into market sentiment and potential investment opportunities.

The Fear Index vix ART PRINT Fear Index Series wall street | Etsy - Source www.etsy.com

- Market Sentiment Indicator: VIX gauges market fear and uncertainty, rising when investors perceive higher risks.

- Volatility Predictor: It predicts future volatility in the stock market, with higher VIX levels indicating greater expected price swings.

- Trading Strategy: Traders can use VIX to execute volatility-based strategies, such as selling VIX options during periods of low volatility.

- Hedge Against Market Risk: By purchasing VIX futures or options, investors can hedge against potential losses in their portfolios during market downturns.

- Contrarian Indicator: Historically, extreme VIX levels have signaled potential market reversals.

- Correlation with Stock Market: VIX tends to move inversely to the S&P 500, providing a valuable diversification tool.

These key aspects of the VIX highlight its significance in assessing market sentiment, predicting volatility, and implementing trading strategies. Understanding the VIX can empower investors and traders to make informed decisions and navigate market fluctuations effectively.

The Fear Index vix CANVAS PRINT Fear Index Series wall | Etsy - Source www.etsy.com

VIX: The Fear Index Explained And How To Trade It

The VIX (Volatility Index) is a measure of market volatility. It is calculated by taking the square root of the sum of the squared differences between the current index level and the index level at each of the next 30 days. The VIX is a popular indicator of market sentiment, as it tends to rise when investors are fearful and fall when investors are confident.

The VIX can be traded through a variety of financial instruments, including futures, options, and exchange-traded funds (ETFs). VIX futures are the most popular way to trade the VIX, as they offer the most leverage and liquidity. VIX options provide a way to speculate on the future direction of the VIX, while VIX ETFs offer a way to track the VIX without having to trade futures or options.

VIX: What you should know about the volatility index – Standard - Source www.sc.com

The VIX is a useful tool for investors who want to manage their risk. By understanding how the VIX works, investors can make informed decisions about when to buy and sell stocks and other assets. The VIX can also be used to hedge against market volatility.

Key Insights:

- The VIX is a measure of market volatility.

- The VIX can be traded through a variety of financial instruments.

- The VIX is a useful tool for investors who want to manage their risk.

Conclusion

The VIX is a valuable tool for investors who want to understand market sentiment and manage their risk. By understanding how the VIX works, investors can make informed decisions about when to buy and sell stocks and other assets.

The VIX is also a useful tool for traders who want to speculate on the future direction of market volatility. VIX futures and options provide a way to profit from changes in the VIX, while VIX ETFs offer a way to track the VIX without having to trade futures or options.