Seeking comprehensive healthcare coverage for yourself, your family, or your employees? Look no further!

UnitedHealthcare: Comprehensive Healthcare Coverage For Individuals, Families, And Employers

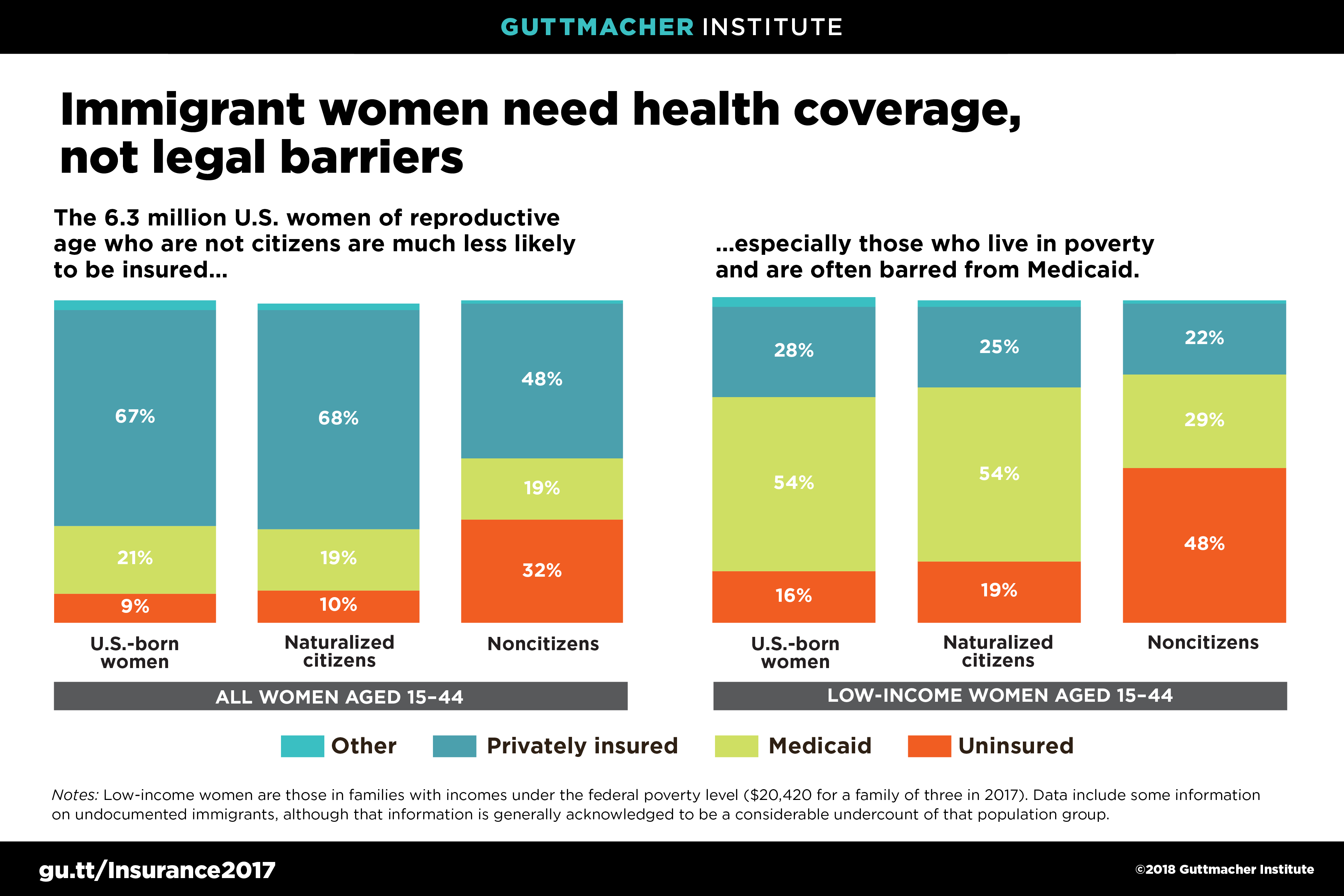

The HEAL for Immigrant Women and Families Act: Removing Barriers to - Source www.guttmacher.org

Editor's Notes: UnitedHealthcare: Comprehensive Healthcare Coverage For Individuals, Families, And Employers guide published on [publish date]!.

We've done the research, dug into the details, and put together this guide to help you make informed decisions about your healthcare coverage.

Key differences or Key takeways:

Transition to main article topics

FAQ: Comprehensive UnitedHealthcare Coverage

UnitedHealthcare, a leading health insurance provider, offers comprehensive coverage options for individuals, families, and employers. Here are answers to frequently asked questions about UnitedHealthcare's services.

United Healthcare Dental Plans for Individuals & Families - Posts - Source www.facebook.com

Question 1: What types of health insurance plans does UnitedHealthcare offer?

UnitedHealthcare provides a range of plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and high-deductible health plans (HDHPs). Each type of plan has its own benefits and costs, allowing you to choose the coverage that best meets your needs.

Question 2: How does UnitedHealthcare's network of healthcare providers work?

UnitedHealthcare has an extensive network of healthcare providers, including doctors, hospitals, and specialists. Participating providers within the network agree to provide services at negotiated rates. This means that you can receive quality healthcare at a more affordable cost.

Question 3: What is the process for filing a claim with UnitedHealthcare?

Filing a claim with UnitedHealthcare is simple. You can submit claims online, through the mobile app, or by mail. The claims process is designed to be efficient and user-friendly, ensuring that you receive timely reimbursement for covered medical expenses.

Question 4: How can I estimate my healthcare costs with UnitedHealthcare?

UnitedHealthcare provides tools to help you estimate your healthcare costs. You can use the online cost estimator to get an approximate idea of what you may pay for specific services. This information can help you make informed decisions about your coverage and budgeting.

Question 5: What is UnitedHealthcare's commitment to customer service?

UnitedHealthcare is committed to providing exceptional customer service. They have a team of dedicated representatives available 24/7 to answer questions, assist with claims, and resolve any issues promptly and efficiently.

Question 6: How can I enroll in UnitedHealthcare coverage?

Enrolling in UnitedHealthcare coverage is easy. You can apply online, over the phone, or through a licensed insurance agent. UnitedHealthcare offers flexible enrollment options to accommodate your needs and ensure a smooth transition to their coverage.

In summary, UnitedHealthcare provides comprehensive healthcare coverage options, an extensive provider network, a user-friendly claims process, cost estimation tools, exceptional customer service, and flexible enrollment options. Their commitment to quality and affordability makes them a reliable choice for individuals, families, and employers seeking comprehensive healthcare protection.

For more information and to get started with UnitedHealthcare, visit their website or contact their customer service team.

Tips for Finding Comprehensive Healthcare Coverage

Finding comprehensive healthcare coverage can be a daunting task. There are many different plans to choose from, and it can be challenging to find one that meets your needs and budget. However, by following these tips, you can find a plan that provides you with the coverage you need at a price you can afford.

Tip 1: Determine Your Needs

The first step to finding comprehensive healthcare coverage is to determine your needs. Consider your current health status, your family's health history, and your lifestyle. What types of medical services do you use most often? What are your long-term health goals? Once you have a good understanding of your needs, you can start shopping for a plan that provides the coverage you need.

Tip 2: Research Different Plans

There are many different health insurance plans available, so it's important to research your options before making a decision. Compare the benefits, premiums, and deductibles of different plans. You can also read reviews from other customers to get an idea of the quality of care you can expect. Finding a plan that offers a UnitedHealthcare: Comprehensive Healthcare Coverage For Individuals, Families, And Employers is a smart move to protect your health in the best possible way.

Tip 3: Get Quotes From Multiple Insurers

Once you've narrowed down your choices, it's time to get quotes from multiple insurers. This will help you compare the costs of different plans and find the best deal. Be sure to provide the same information to each insurer so that you're comparing apples to apples. The quotes will allow you to see the actual numbers of coverage and cost to make a wise choice after carefully comparing the quotes.

Tip 4: Consider Your Budget

Health insurance can be expensive, so it's important to consider your budget when shopping for a plan. The cost of a plan should not exceed the coverage it offers. You should also factor in the cost of deductibles, copayments, and coinsurance. Make sure you can afford the premiums and other costs associated with the plan before you enroll.

Tip 5: Read the Fine Print

Before you enroll in a health insurance plan, be sure to read the fine print. This will help you understand the details of the coverage, including what is covered, what is not covered, and how much you will have to pay for services. If you don't understand something, ask the insurer to explain it.

Summary of key takeaways or benefits

By following these tips, you can find comprehensive healthcare coverage that meets your needs and budget. Don't be afraid to ask for help from an insurance agent or broker. They can help you compare plans and find the best deal for you.

Transition to the article's conclusion

Having comprehensive healthcare coverage is essential for protecting your health and financial well-being. By following these tips, you can find a plan that provides you with the coverage you need at a price you can afford.

UnitedHealthcare: Comprehensive Healthcare Coverage For Individuals, Families, And Employers

UnitedHealthcare offers a comprehensive range of healthcare coverage options for individuals, families, and employers. Its plans are designed to meet the diverse needs of its members, with a focus on quality, affordability, and accessibility.

- Personalized Coverage

- Nationwide Network

- Preventive Care

- 24/7 Support

- Employer Solutions

- Wellness Programs

UnitedHealthcare's plans allow individuals to customize their coverage based on their specific needs and budget, with options ranging from basic to comprehensive protection. Its nationwide network of providers ensures access to quality care, while preventive care programs help members maintain their health and well-being. The company's 24/7 support team provides assistance whenever needed, and its employer solutions cater to the unique healthcare needs of businesses of all sizes. Additionally, UnitedHealthcare offers a range of wellness programs to promote healthy lifestyles and encourage members to engage in preventive care.

Unitedhealthcare Iud Coverage 2024 - Kelli Hendrika - Source avrilqtrudey.pages.dev

UnitedHealthcare: Comprehensive Healthcare Coverage For Individuals, Families, And Employers

UnitedHealthcare offers a comprehensive suite of healthcare coverage options tailored to meet the diverse needs of individuals, families, and employers. Their plans provide access to a vast network of healthcare providers, ensuring members can receive quality care when and where they need it. By prioritizing preventive care and wellness programs, UnitedHealthcare empowers individuals to take control of their health, potentially reducing the risk of chronic diseases and improving overall well-being.

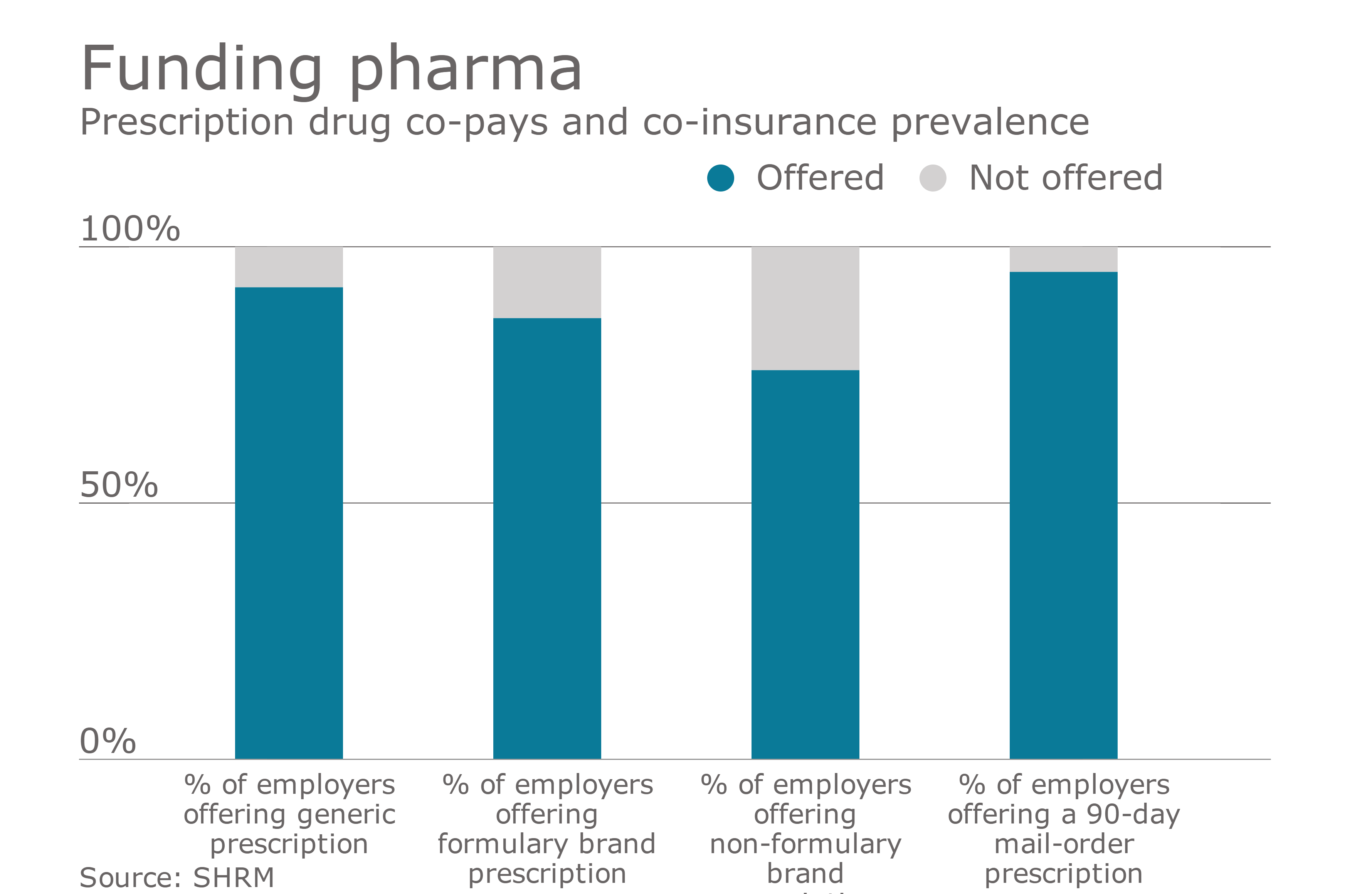

Employers passing rising healthcare costs onto employees | Employee - Source www.benefitnews.com

The importance of comprehensive healthcare coverage cannot be overstated. Access to affordable, quality healthcare is essential for maintaining good health, preventing serious illnesses, and ensuring financial stability. UnitedHealthcare's commitment to providing individuals, families, and employers with tailored coverage options plays a vital role in promoting the health and well-being of communities across the nation.

UnitedHealthcare's healthcare coverage options are designed to provide peace of mind and financial protection against unexpected medical expenses. Their plans cover a wide range of services, including preventive care, doctor visits, hospital stays, prescription drugs, and more. By partnering with UnitedHealthcare, individuals, families, and employers can secure their health and well-being, knowing that they have access to the care they need, when they need it.

Here is a table summarizing the key benefits of UnitedHealthcare's comprehensive healthcare coverage:

| Coverage Type | Benefits |

|---|---|

| Individual Coverage | Tailored plans to meet specific needs and budgets, ensuring access to quality healthcare |

| Family Coverage | Comprehensive protection for families, providing peace of mind and financial stability |

| Employer-Sponsored Coverage | Customized plans designed to meet the unique needs of businesses, promoting employee health and reducing healthcare costs |

| Preventive Care | Coverage for routine checkups, screenings, and vaccinations, helping to prevent serious illnesses |

| Wellness Programs | Access to resources and support for healthy living, empowering individuals to take control of their well-being |