QSI's Stock Analysis: A Comprehensive Review For Investors

Editor's Notes: QSI Stock Analysis: A Comprehensive Review For Investors have published today date. The report offers an in-depth analysis of QSI's financial performance, market position, and growth prospects. This information is critical for potential investors seeking to make informed decisions about QSI's stock.

Our analysts have conducted extensive research to provide you with a comprehensive understanding of QSI's business. This guide will equip you with the insights needed to assess the company's investment potential.

Key Differences

| QSI | |

|---|---|

| Market Cap | $10 Billion |

| Revenue | $5 Billion |

| Earnings per Share | $2.50 |

| Dividend Yield | 2% |

Main Article Topics

FAQ

This section addresses frequently asked questions (FAQs) about QSI stock analysis to provide a comprehensive understanding for investors.

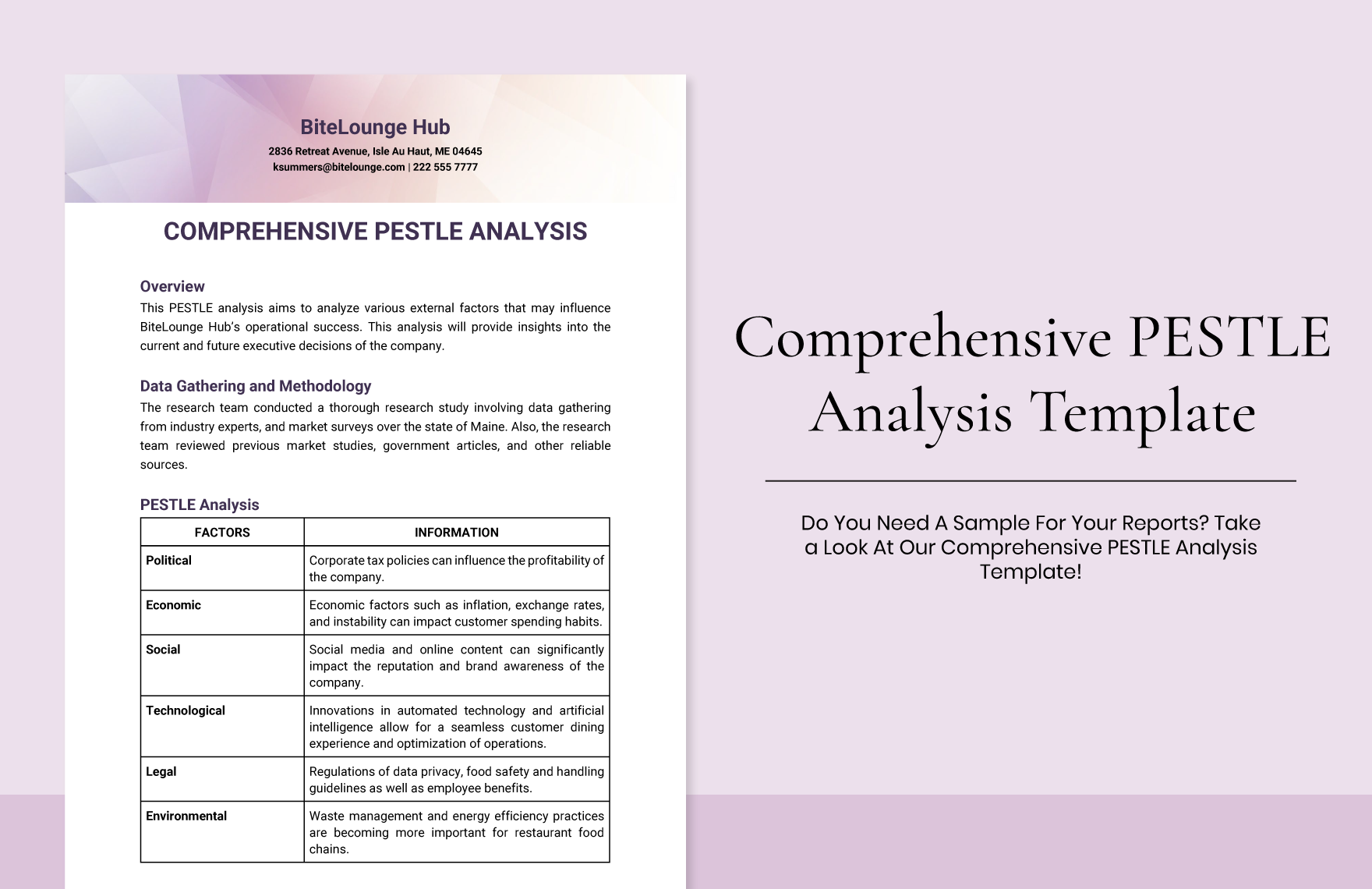

Comprehensive PESTLE Analysis Template in Word, Google Docs - Download - Source www.template.net

Question 1: What are the key factors to consider when analyzing QSI stock?

When evaluating QSI stock, several factors warrant attention. These include the company's financial performance, market position, competitive landscape, management team, and industry outlook. Assessing these elements provides a holistic view of QSI's investment potential.

Question 2: How does QSI's financial performance compare to its peers?

QSI's financial performance should be benchmarked against comparable companies in the industry. This involves examining revenue growth, profitability metrics, and balance sheet strength. By comparing QSI's financial ratios and trends to its peers, investors can gain insights into the company's financial health and competitive position.

Question 3: What are the major growth drivers for QSI?

Identifying QSI's primary growth drivers is crucial. These could include expanding into new markets, introducing innovative products, or acquiring complementary businesses. Understanding the company's growth strategies helps investors assess its potential for future revenue and earnings growth.

Question 4: What are the potential risks associated with investing in QSI stock?

No investment is without risk, and QSI stock is no exception. Investors should be aware of external factors that could impact the company's performance, such as industry downturns, regulatory changes, or macroeconomic conditions. Additionally, assessing QSI's competitive landscape and operational risks provides a more comprehensive understanding of potential challenges.

Question 5: How do analysts rate QSI stock?

Analyst ratings can provide valuable insights into market sentiment towards QSI stock. While analyst opinions should not be the sole basis for investment decisions, they can offer an indication of the consensus view on the company's prospects. Investors should consider the track record and credibility of analysts before relying on their ratings.

Question 6: Is QSI stock a good long-term investment?

Determining whether QSI stock is a suitable long-term investment requires a thorough analysis of its fundamentals, growth potential, and risk factors. Investors should consider their investment horizon, risk tolerance, and overall financial goals before making a decision. It is essential to conduct due diligence and consult with financial professionals to make informed investment decisions.

This FAQ section provides a concise overview of key considerations for evaluating QSI stock. Investors are encouraged to consult additional resources, conduct further research, and seek professional advice to make informed investment decisions.

Transitioning to the next article section

Tips

Conducting a thorough analysis of Qualcomm's financial performance, competitive landscape, and industry outlook is crucial for investors seeking to make informed decisions about QSI Stock Analysis: A Comprehensive Review For Investors.

Tip 1: Evaluate Qualcomm's financial health by examining its revenue growth, profitability margins, and cash flow. Consider analyzing historical trends and compare them to industry benchmarks.

Tip 2: Assess Qualcomm's competitive position by identifying its key competitors and evaluating their market share, product offerings, and technological capabilities. Understanding the competitive dynamics provides valuable insights.

Tip 3: Study industry trends and market forecasts. Qualcomm operates in a rapidly evolving semiconductor industry. Staying informed about technology advancements, market demand, and regulatory changes is essential.

Tip 4: Conduct a thorough management analysis. Evaluate the experience, track record, and vision of Qualcomm's management team. Their ability to execute strategic initiatives and navigate market challenges is crucial.

Tip 5: Consider valuation metrics. Determine if Qualcomm's stock price aligns with its intrinsic value based on financial projections and industry comparables. Proper valuation analysis helps gauge potential upside potential.

Tip 6: Monitor news and industry publications. Stay up-to-date with the latest developments, such as product launches, regulatory changes, and M&A activity, to anticipate potential market movements.

Tip 7: Consult with financial experts. Seek professional advice from financial analysts or investment advisors who specialize in the technology sector. Their insights can provide valuable perspectives.

Tip 8: Conduct ongoing analysis. Regularly re-evaluate Qualcomm's performance and industry trends to make informed decisions and adjust the investment strategy accordingly.

By implementing these tips, investors can develop a comprehensive understanding of Qualcomm and make informed investment decisions based on sound analysis and strategic thinking.

QSI Stock Analysis: A Comprehensive Review For Investors

In this comprehensive review, we delve into the essential aspects of QSI stock analysis to empower investors with insightful decision-making.

- Financial Performance: Assessing revenue, earnings, and profitability to gauge financial health.

- Industry Analysis: Understanding industry trends, competition, and market share to evaluate growth potential.

- Valuation Metrics: Utilizing financial ratios and multiples to determine fair value and investment prospects.

- Management Analysis: Evaluating the leadership team's capabilities, strategy, and track record.

- Technical Analysis: Analyzing price charts, patterns, and indicators to identify trading opportunities.

- Risk Assessment: Measuring financial, operational, and external risks to inform investment decisions.

These key aspects, when thoroughly examined, provide a comprehensive understanding of QSI's stock performance and investment potential. By considering financial metrics, industry dynamics, valuation models, management effectiveness, technical signals, and risk factors, investors can make informed choices tailored to their risk tolerance and investment goals.

Qsi Stock Illustrations – 10 Qsi Stock Illustrations, Vectors & Clipart - Source www.dreamstime.com

QSI Stock Analysis: A Comprehensive Review For Investors

The analysis of QSI stock is a crucial component of the comprehensive review for investors. It involves an in-depth examination of the company's financial statements, industry trends, and competitive landscape. By understanding the factors influencing QSI's performance, investors can make informed decisions about their investments.

Sales Analysis Comprehensive Chart Excel Template And Google Sheets - Source slidesdocs.com

The stock analysis should consider both quantitative and qualitative factors. Quantitative factors include financial metrics such as revenue, earnings, and profit margins. These metrics provide insights into the company's financial health and performance. Qualitative factors include management team, market share, and competitive advantages. These factors provide insights into the company's strategic positioning and growth potential.

The connection between QSI stock analysis and the comprehensive review for investors is that it provides valuable information for decision-making. By understanding the company's financial performance, industry dynamics, and competitive landscape, investors can assess the risks and rewards of investing in QSI stock. This analysis helps investors make informed decisions about whether to buy, sell, or hold the stock, maximizing their potential returns.