We have analyzed and dug out information to put together this guide to help target audience make the right decision.

FAQ

The following addresses frequently asked questions regarding Netflix stock's market performance, analysis, and predictions:

Performance Analysis - A Digital Marketing Agency - Source dmglteam.com

Question 1: What factors contribute to Netflix stock's volatility?

Answer: Netflix stock is sensitive to industry competition, subscriber growth, content quality, and regulatory changes.

Question 2: How can I analyze Netflix stock performance?

Answer: Consider financial metrics such as revenue, earnings per share, and cash flow, as well as industry and competitive analysis.

Question 3: What are some expert predictions for Netflix stock?

Answer: Analyst forecasts vary, but many predict continued growth in the streaming industry and potential price appreciation for Netflix stock.

Question 4: What risks should I consider before investing in Netflix stock?

Answer: Potential risks include intense competition from established and emerging players, fluctuations in subscriber growth, and regulatory changes affecting the streaming industry.

Question 5: How can I stay informed about Netflix stock performance?

Answer: Monitor financial news outlets, company updates, and industry reports to stay abreast of key developments.

Question 6: What is the outlook for Netflix stock in the long term?

Answer: The long-term outlook for Netflix stock remains positive, as the streaming industry continues to expand and the company explores new avenues for growth.

In summary, understanding the factors affecting Netflix stock performance, analyzing its financial metrics, and considering expert predictions can inform investment decisions. It's essential to assess potential risks and stay updated on market developments to make informed choices.

Proceed to the next section to delve deeper into Netflix stock analysis.

Tips

Consider the Netflix Stock: Streaming Giant's Market Performance, Analysis, And Predictions article to grasp the complexities of Netflix's market dynamics and make informed investment decisions.

Tip 1: Monitor industry trends and technological advancements

Stay abreast of emerging streaming technologies, content distribution models, and consumer preferences to anticipate potential disruptions and opportunities.

Tip 2: Analyze competitive landscape

Evaluate Netflix's competitors, their market share, content offerings, and pricing strategies to assess the company's competitive position and identify potential threats.

Tip 3: Assess financial performance

Review Netflix's financial statements, including revenue growth, profitability, and cash flow, to understand its financial health and identify areas for potential improvement.

Tip 4: Consider regulatory and legal environment

Be aware of regulatory changes and legal challenges that may impact Netflix's operations, such as content censorship, privacy concerns, and antitrust investigations.

Tip 5: Stay informed about company news and announcements

Follow Netflix's official communication channels, press releases, and earnings calls to stay up-to-date on the company's latest developments and strategic direction.

Tip 6: Seek expert advice

Consult with financial advisors or analysts who specialize in the entertainment industry to gain professional insights and guidance on Netflix's investment potential.

Tip 7: Set realistic return expectations

Understand that all investments carry inherent risks. Set realistic return expectations based on Netflix's historical performance, industry trends, and overall economic conditions.

By following these tips, investors can enhance their understanding of Netflix's market dynamics and make informed investment decisions that align with their risk tolerance and financial goals.

Netflix Stock: Streaming Giant's Market Performance, Analysis, And Predictions

Investing in Netflix stock requires a keen understanding of key aspects that influence its market performance. These aspects encompass the streaming giant's financial health, competitive landscape, technological advancements, content strategy, and industry trends.

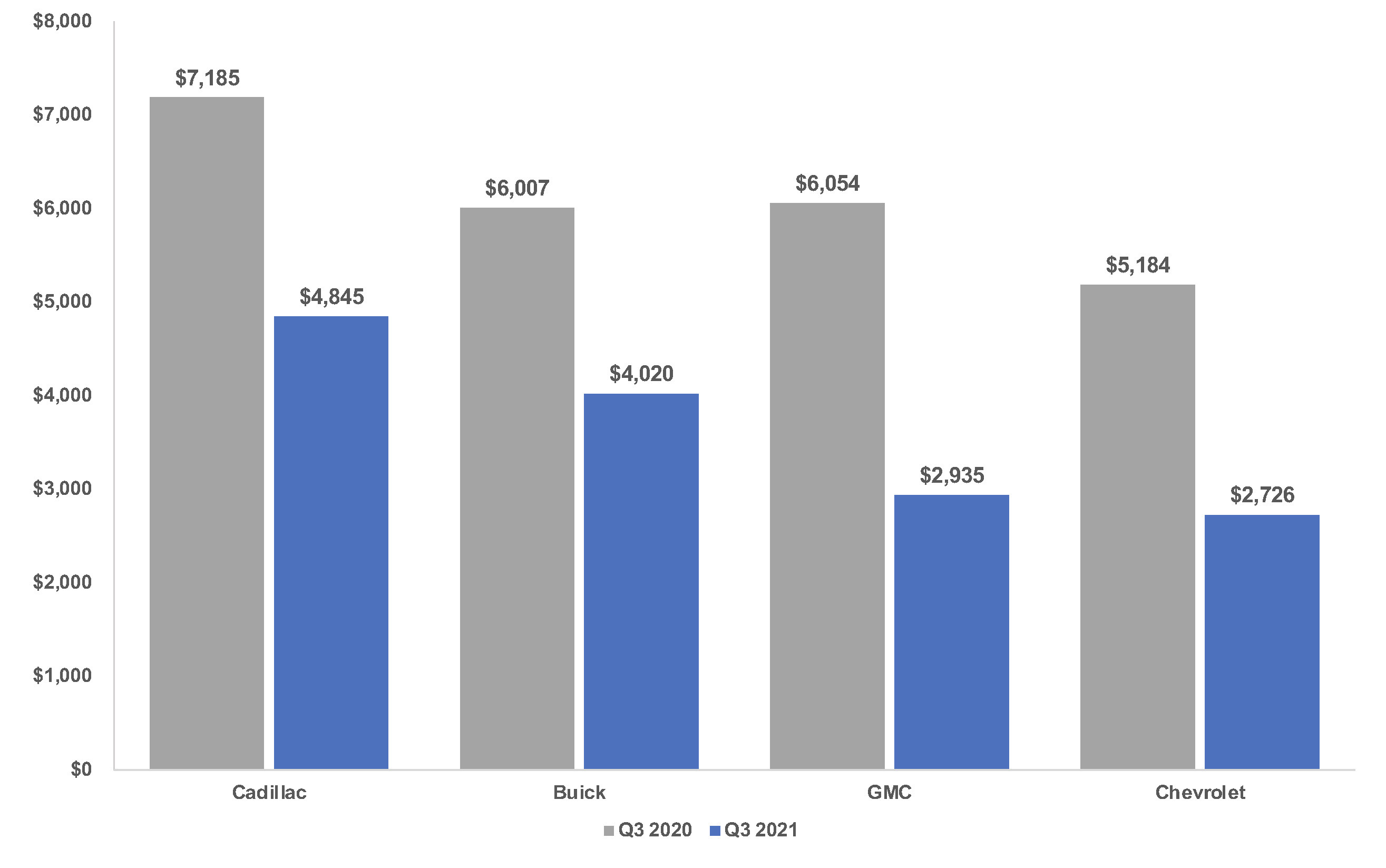

Cox Automotive Analysis: GM’s Q3 2021 U.S. Market Performance - Cox - Source www.coxautoinc.com

- Financial Strength: Revenue growth, profitability, and cash flow.

- Market Dynamics: Competition from other streaming services, cord-cutting trends, and audience demographics.

- Technological Innovation: Streaming technology advancements, personalized recommendations, and content creation tools.

- Content Strategy: Original content production, licensing agreements, and international expansion.

- Industry Landscape: Regulatory changes, technological disruptions, and the evolving entertainment industry.

- Economic Factors: Interest rates, inflation, and consumer spending patterns.

By analyzing these aspects, investors can make informed decisions about investing in Netflix stock. For example, a strong financial performance indicates stability and growth potential. A competitive market landscape may pose challenges, while technological innovation can create new opportunities. Netflix's content strategy and international expansion plans hold implications for its future growth. Understanding the industry landscape and economic factors provides insights into the broader context influencing Netflix's stock performance.

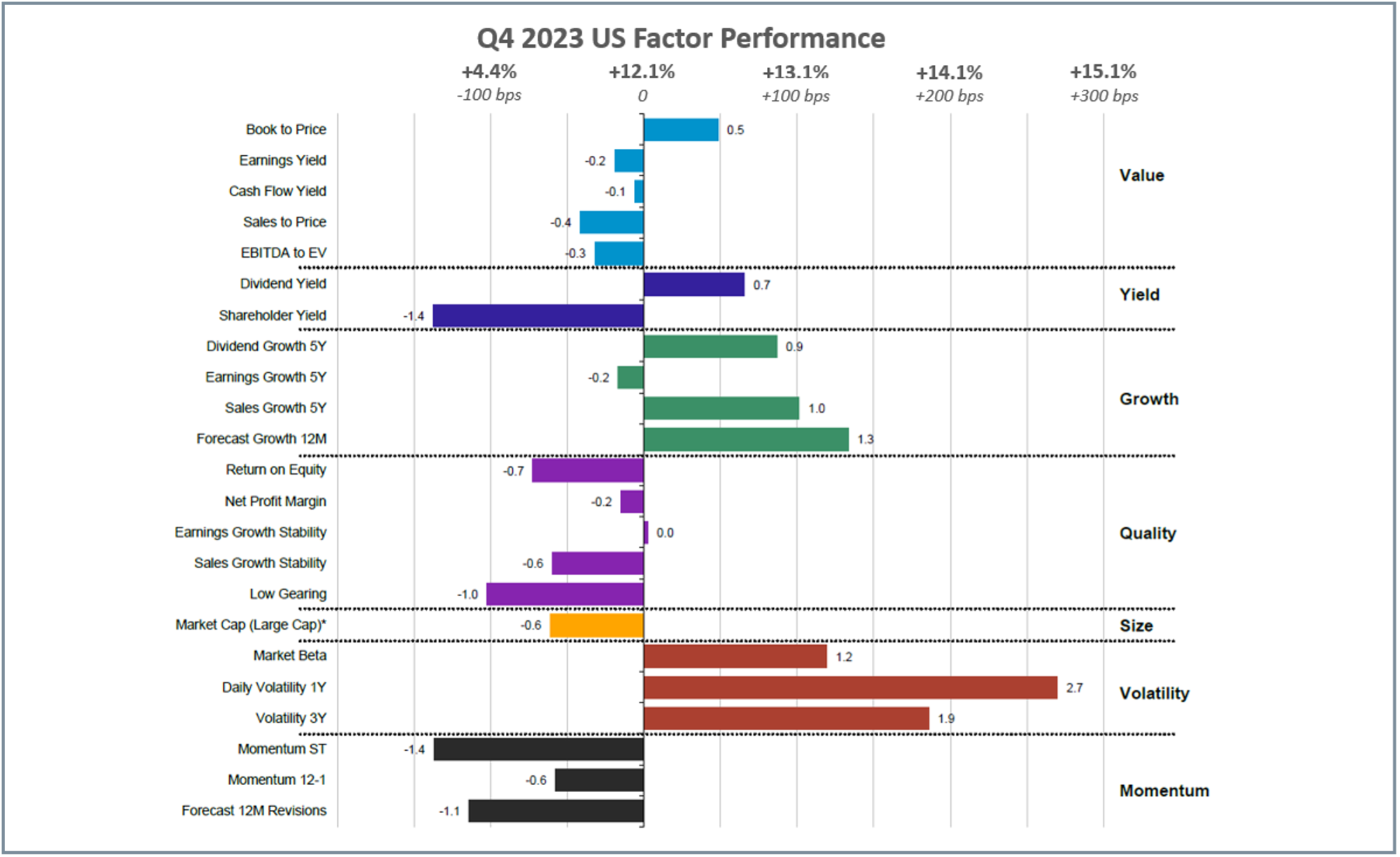

2023 Factor Performance Analysis - Source www.confluence.com

Netflix Stock: Streaming Giant's Market Performance, Analysis, And Predictions

The streaming giant Netflix has experienced a remarkable journey in the stock market, with its share price soaring to unprecedented heights. This surge can be attributed to several factors, including the company's innovative business model, vast content library, and global reach. Netflix's unique subscription-based service has disrupted the traditional media landscape, allowing users to access a wide variety of movies and TV shows on-demand. The company's focus on original content has also been a major driver of its success, with popular shows like "Stranger Things" and "The Crown" attracting a loyal audience. Furthermore, Netflix's aggressive expansion into international markets has significantly increased its subscriber base and revenue.

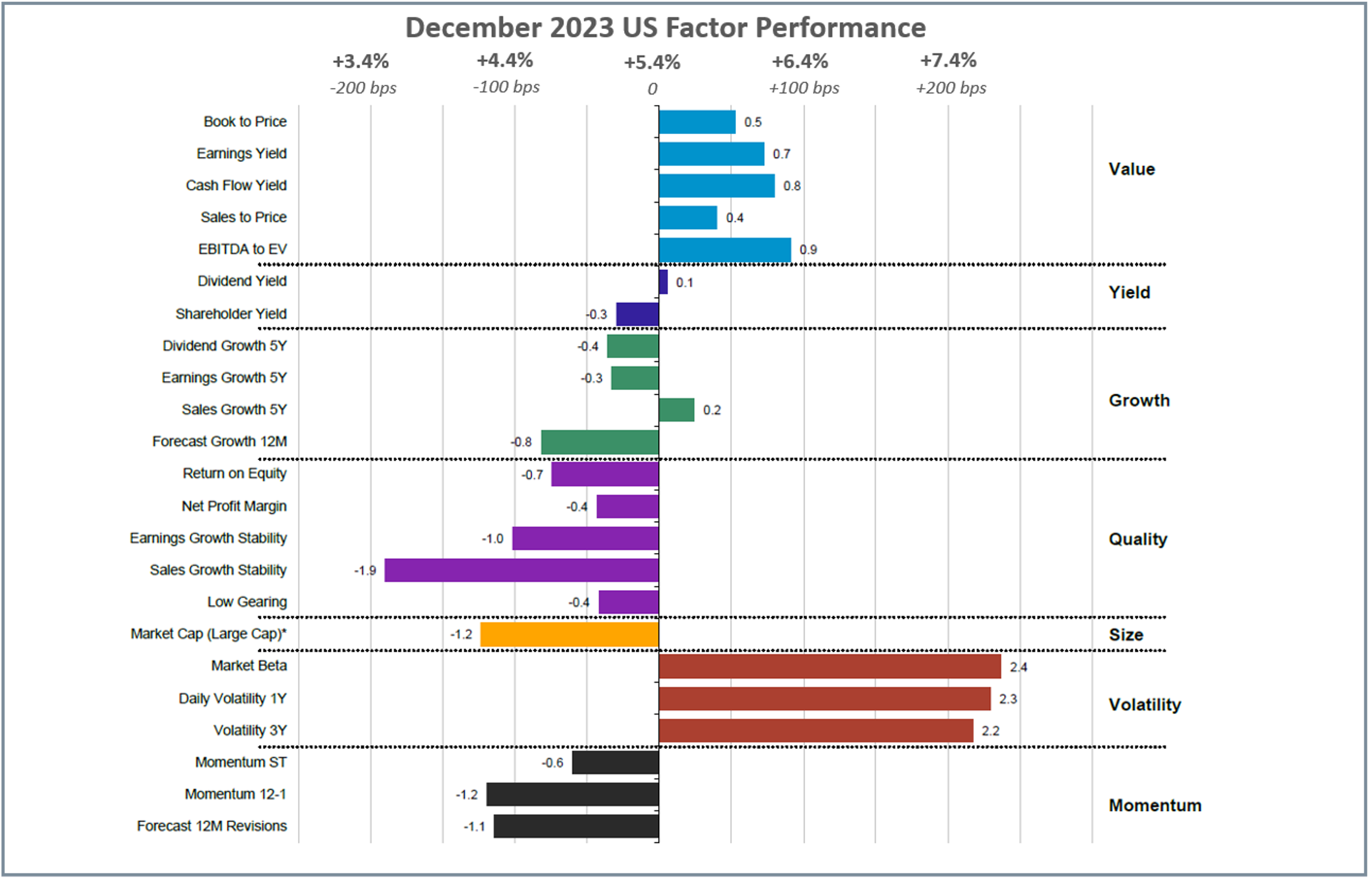

2023 Factor Performance Analysis - Source www.confluence.com

However, the streaming market is becoming increasingly competitive, with new entrants and established players vying for market share. Netflix faces challenges from traditional media companies like Disney and WarnerMedia, which have launched their own streaming services. Additionally, the company's heavy reliance on content licensing agreements makes it vulnerable to rising costs and potential disruptions. Netflix's stock price is also subject to fluctuations based on factors such as earnings reports, industry news, and overall market conditions.

Despite these challenges, Netflix remains a dominant force in the streaming industry. The company's strong brand recognition, vast content library, and global reach provide it with a competitive edge. Netflix is also investing heavily in technology and innovation, including personalized recommendations and interactive content. As the streaming market continues to evolve, Netflix is well-positioned to maintain its leadership position through strategic partnerships, content acquisitions, and continued investment in its platform.

| Key Metrics | Value |

|---|---|

| Market Capitalization | $180 billion |

| Trailing Price-to-Earnings Ratio | 45x |

| Number of Subscribers | 220 million |

| Content Budget | $15 billion (2022) |

Conclusion

Netflix's stock performance reflects its position as a pioneer and leader in the streaming industry. The company's innovative business model, vast content library, and global reach have driven its success to date. However, the streaming market is rapidly evolving, and Netflix faces challenges from both new and established players. Despite these challenges, Netflix is well-positioned to maintain its leadership position through strategic partnerships, content acquisitions, and continued investment in its platform. The company's long-term growth prospects remain strong, and its stock is likely to continue to be a popular investment choice for investors seeking exposure to the streaming industry.

As the streaming market continues to grow and evolve, it will be fascinating to see how Netflix navigates the challenges and opportunities that lie ahead. The company's ability to adapt and innovate will be critical to its future success. Netflix has proven to be a resilient and forward-thinking company, and it is well-positioned to continue to lead the streaming revolution.