Editor's Notes: With the rising cost of living, it's more important than ever to be able to split expenses fairly. That's why we've put together this guide to help you navigate the tricky world of shared costs.

After analyzing dozens of articles and digging into the latest research, we've put together this guide to help you make the right decision for your situation.

Key Takeaways

| Splitting Evenly | Splitting Proportionally | Splitting Based on Consumption |

| - Everyone pays the same amount, regardless of how much they use the service or product | - Each person pays a share that is proportional to their use of the service or product | - Each person pays for what they use, with no one subsidizing anyone else |

FAQs

This comprehensive guide addresses frequently asked questions and concerns related to splitting expenses fairly. Whether you're navigating shared expenses with friends, family, or colleagues, these answers provide valuable insights and best practices.

Excel Spreadsheet For Splitting Expenses for Split Expenses Spreadsheet - Source db-excel.com

Question 1: What is the most equitable way to split expenses?

The most equitable method depends on the specific situation. Common approaches include splitting expenses equally, proportioning them based on usage or consumption, or considering each person's financial situation.

Question 2: How do you handle situations where one person spends more than others?

Communicating openly and discussing spending habits can help resolve such situations. Consider adjusting the split ratio, creating a budget, or exploring alternative arrangements, such as taking turns covering certain expenses.

Question 3: What are some tips for preventing conflicts over expenses?

Establish clear expectations, track expenses diligently, and communicate regularly about financial matters. Being transparent and accountable fosters trust and reduces misunderstandings.

Question 4: How do you deal with overspenders or those who refuse to contribute?

Address these issues directly and tactfully. Explain the importance of shared responsibility and consider setting limits or boundaries to prevent excessive spending. If necessary, seek mediation or legal advice to resolve persistent disputes.

Question 5: How can you ensure fairness when expenses vary in nature?

Break down expenses into categories and allocate them accordingly. For example, rent and utilities can be split equally, while groceries or entertainment costs can be proportionated based on individual consumption.

Question 6: What role does technology play in splitting expenses?

Digital platforms and apps can simplify expense tracking, create budgets, and facilitate payments. They provide transparency, automate calculations, and minimize the risk of human error.

By addressing these common concerns and providing practical solutions, this guide empowers you to navigate the complexities of splitting expenses fairly, fostering harmonious relationships and ensuring financial equity.

Continue reading for more insights and strategies to effectively manage shared expenses.

Tips

For tips on how to split expenses fairly, read Going Dutch: The Ultimate Guide To Splitting Expenses Fairly. Tips highlighted include:

Tip 1: Establish clear expectations from the outset

Discuss and agree on how expenses will be split before you start spending money together. This will help to avoid any misunderstandings or disagreements later on.

Tip 2: Keep track of expenses

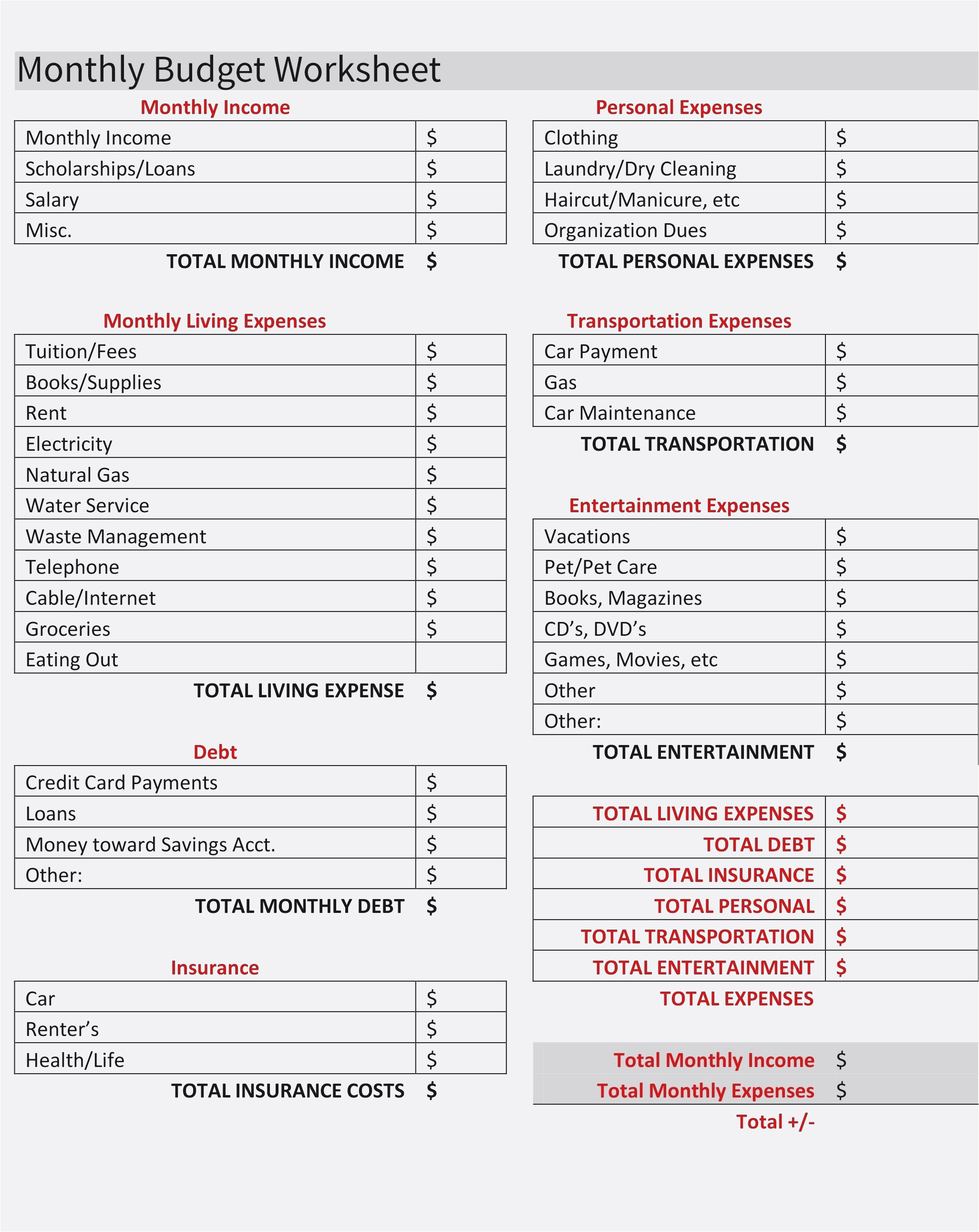

Use a spreadsheet or app to track all of your expenses, so that you can easily see how much each person owes.

Tip 3: Split expenses equitably

Don't always split expenses down the middle. Instead, try to split them according to how much each person used or benefited from the expense.

Tip 4: Be flexible

There may be times when it's not possible to split expenses exactly evenly. Be flexible and willing to compromise, so that everyone feels like they're getting a fair deal.

Tip 5: Communicate openly and honestly

If you have any concerns about how expenses are being split, talk to your friends or roommates openly and honestly. This will help to avoid any resentment or misunderstandings.

Tip 6: Use a budgeting app

There are many budgeting apps available that can help you to track your expenses and split them fairly. This can make it a lot easier to manage your finances and avoid any disagreements.

Tip 7: Be prepared to compromise

There may be times when you need to compromise on how you split expenses. This is especially important if you're sharing expenses with someone who has a different financial situation than you.

Tip 8: Don't be afraid to ask for help

If you're having trouble splitting expenses fairly, don't be afraid to ask for help from a friend, family member, or financial advisor.

By following these tips, you can help to ensure that you're splitting expenses fairly and avoiding any misunderstandings or disagreements.

Going Dutch: The Ultimate Guide To Splitting Expenses Fairly

Dividing costs equitably, known as "Going Dutch," is a crucial social etiquette. This guide unveils six core principles for fair expense distribution, exploring aspects of fairness, transparency, and practicality.

The Reason We Call Splitting the Bill "Going Dutch" | Reader's Digest - Source www.rd.com

- Transparency: Open communication ensures everyone is aware of expenses and expectations.

- Equal Shares: Divide expenses among all participants equally, regardless of individual consumption.

- Proportional Split: Divide expenses based on each person's consumption or usage of the shared service.

- Fixed Contributions: Set predetermined amounts for each person, regardless of actual expenses.

- Rounding and Estimation: Divide expenses roughly to avoid excessive precision and potential disputes.

- Technology Tools: Utilize expense-tracking apps or online calculators for accuracy and convenience.

These principles promote fairness and clarity in expense sharing. Transparency fosters trust, while equal shares ensure no one overpays. Proportional splits reflect actual usage, fixed contributions simplify calculations, and rounding minimizes disputes. Technology tools streamline the process and provide a clear record of expenses. Whether settling restaurant bills, organizing group trips, or managing shared housing, understanding these key aspects will guide effective "Going Dutch" practices.

A Landlord’s Guide to Fairly Splitting Utilities Between Tenants - Source www.wolfnest.com

Going Dutch: The Ultimate Guide To Splitting Expenses Fairly

"Going Dutch" refers to the practice of splitting expenses equally among participants in a group activity or shared expense, such as meals, travel, or household bills. This concept ensures fairness and transparency in financial arrangements, particularly when individuals have different spending habits or financial capabilities. Understanding the principles of "Going Dutch" is crucial for maintaining harmonious relationships within groups.

Excel Spreadsheet For Splitting Expenses Spreadsheet Downloa excel - Source db-excel.com

This article serves as a comprehensive guide to "Going Dutch," offering practical tips and insights to help groups navigate the complexities of splitting expenses. It explores the importance of communication, setting clear expectations, and addressing potential challenges. By adhering to the principles outlined in this article, individuals can ensure equitable expense sharing, foster trust, and avoid misunderstandings among group members.

In real-world scenarios, "Going Dutch" can be applied to various situations, such as:

- Splitting the cost of dinner among friends or colleagues

- Sharing expenses for a group vacation or event

- Dividing utility and rent bills among roommates or housemates

In each case, following the principles of "Going Dutch" ensures transparency, accountability, and fairness, promoting healthy financial relationships within the group.

Ultimately, the key to successful "Going Dutch" arrangements lies in open communication, clear expectations, and a willingness to compromise when necessary. By embracing these principles, groups can navigate the complexities of shared expenses with confidence, preserving fairness and fostering harmonious relationships.