What does "Citibank: Your Trusted Partner For Comprehensive Financial Solutions" mean? Citibank is a global financial institution that provides a wide range of financial products and services to individuals, businesses, and governments. It is part of the Citigroup family of companies, which also includes Primerica, Diners Club International, and Smith Barney.

Editor's Notes: "Citibank: Your Trusted Partner For Comprehensive Financial Solutions" have published today. We believe Citibank: Your Trusted Partner For Comprehensive Financial Solutions is important because it provides a comprehensive overview of the financial products and services that Citibank offers. This guide can help you make informed decisions about your financial future.

Our team of experts has spent countless hours analyzing and comparing different financial products and services. We've also spoken with financial advisors and consumers to get their insights on Citibank. As a result, we're confident that this guide will provide you with the information you need to make the best financial decisions for yourself and your family.

Here are some of the key differences between "Citibank: Your Trusted Partner For Comprehensive Financial Solutions" and other financial institutions:

| Feature | Citibank | Other Financial Institutions |

|---|---|---|

| Number of products and services offered | Wide range of products and services, including banking, investment, lending, and insurance | Limited range of products and services |

| Global reach | Operates in over 100 countries | Limited global reach |

| Customer service | 24/7 customer service | Limited customer service hours |

Citibank is a trusted partner for comprehensive financial solutions. With its wide range of products and services, global reach, and exceptional customer service, Citibank can help you achieve your financial goals.

FAQ

Citibank, a pillar in the financial industry, recognizes the paramount importance of addressing customers' questions. This FAQ section serves as a comprehensive resource, shedding light on frequently raised inquiries and providing clear, informative answers. Our commitment to transparency and customer satisfaction drives our unwavering dedication to empower you with the knowledge necessary for well-informed financial decisions.

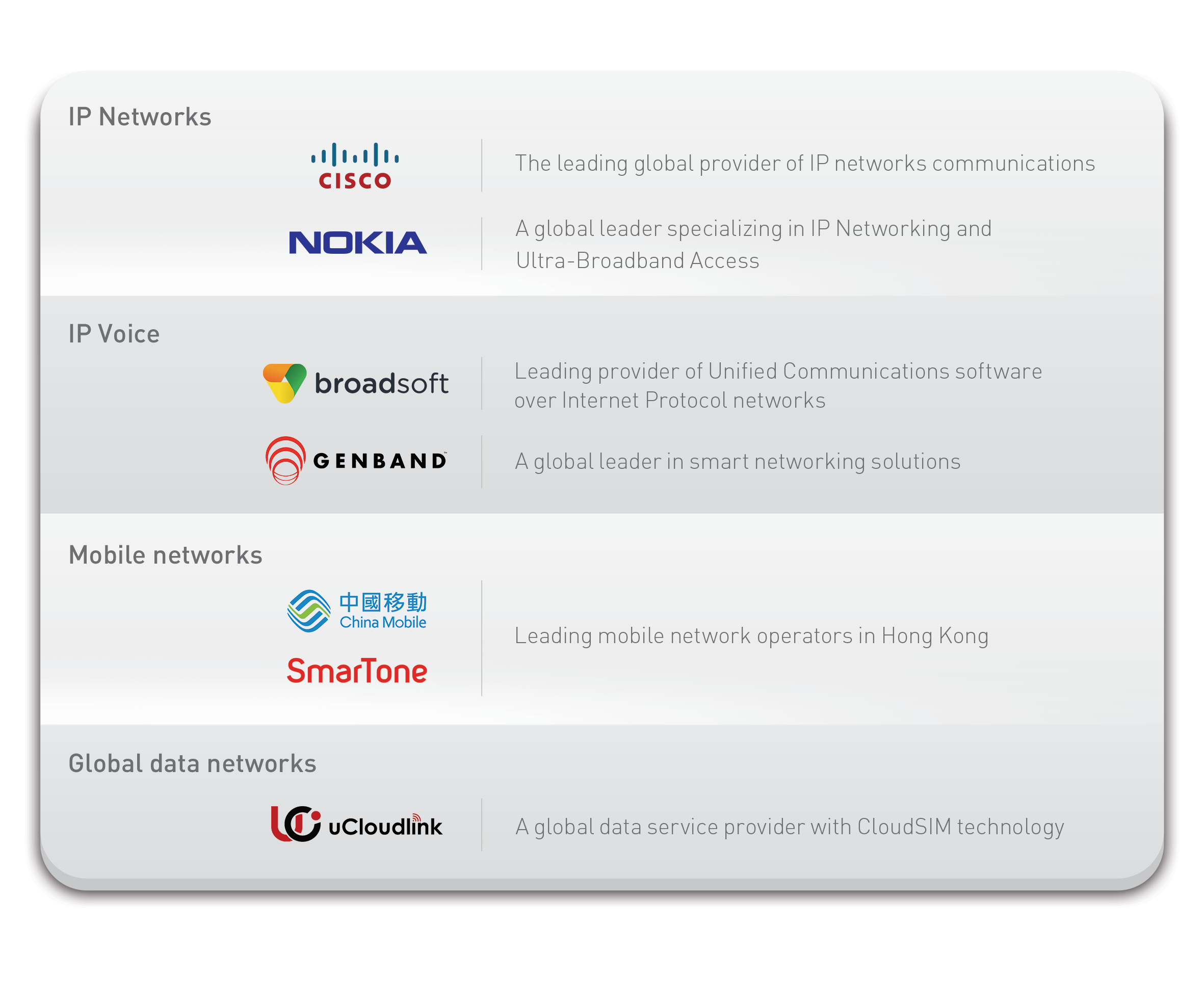

Your Trusted Partner | HKBN Enterprise Solutions - Source www.hkbnes.net

Question 1: What sets Citibank apart as a leading financial institution?

Citibank distinguishes itself through its comprehensive suite of financial products and services, tailored to meet diverse customer needs. Our global presence and unparalleled expertise enable us to provide innovative solutions, leveraging cutting-edge technology to enhance the banking experience. Moreover, our unwavering commitment to customer service ensures personalized, responsive support, solidifying our position as a trusted partner.

Question 2: How does Citibank ensure the security of its customers' financial information?

At Citibank, security is paramount. We employ state-of-the-art encryption technologies and robust security measures to safeguard your sensitive financial data. Our stringent authentication processes and ongoing monitoring protect against unauthorized access and fraudulent activities. Rest assured that your privacy and financial well-being are our utmost priorities.

Question 3: What are the benefits of utilizing Citibank's online banking platform?

Our intuitive online banking platform empowers you with unparalleled convenience and control over your finances. Real-time account monitoring, secure bill payments, and seamless fund transfers are just a few of the functionalities at your fingertips. Additionally, our mobile banking app extends these capabilities, enabling you to manage your banking needs on the go, whenever and wherever.

Question 4: How can Citibank assist me in achieving my financial goals?

Citibank offers a comprehensive range of financial planning services to help you navigate your financial journey. Our expert advisors provide personalized guidance, tailoring investment strategies and wealth management solutions to align with your unique aspirations. Whether you seek to save for the future, safeguard your assets, or build a solid retirement plan, our team is dedicated to empowering your financial success.

Question 5: What sets Citibank credit cards apart from competitors?

Our credit cards are designed to provide unparalleled value and rewards. With a diverse range of cards tailored to specific spending habits and lifestyles, you can earn points, miles, and cash back on everyday purchases. Additionally, our exclusive partnerships offer access to premium travel experiences, dining privileges, and exclusive events, enhancing your lifestyle beyond financial benefits.

Question 6: How does Citibank support social responsibility and community development?

Citibank is deeply committed to being a responsible corporate citizen. We actively invest in initiatives that promote financial inclusion, empower underserved communities, and contribute to sustainable development. Through our philanthropic efforts, employee volunteerism, and strategic partnerships, we strive to create lasting positive impact, recognizing that our success is inextricably linked to the well-being of the communities we serve.

Citibank remains steadfast in its commitment to providing exceptional financial solutions, fostering customer trust, and driving positive change. As we navigate the evolving financial landscape, our dedication to innovation, security, and customer satisfaction will continue to guide our journey.

Discover the transformative power of partnering with Citibank. Explore our comprehensive offerings and experience the unwavering support of a financial institution that prioritizes your success and well-being.

Tips on Managing Your Finances

Effective financial management is crucial for achieving financial stability and long-term success. To assist you in navigating the complexities of personal finance, here are some valuable tips to consider:

Tip 1: Create a Comprehensive Budget

A budget serves as a roadmap for your financial decisions, allowing you to track income, expenses, and savings. Detailed budgeting helps you identify areas where adjustments can be made to optimize financial outcomes.

Tip 2: Reduce Unnecessary Expenses

Review your expenses regularly and identify areas where spending can be reduced. Consider eliminating non-essential items, negotiating lower bills, or exploring cost-effective alternatives. Cutting back on unnecessary expenses can free up funds for important financial goals.

Tip 3: Build an Emergency Fund

Unexpected expenses can disrupt financial stability. Establish an emergency fund to cover unexpected costs, such as medical bills or job loss. Aim to save three to six months' worth of living expenses to provide a financial cushion during challenging times.

Tip 4: Invest for the Future

Investing is crucial for long-term financial growth. Consider a diversified investment portfolio that aligns with your risk tolerance and financial goals. Regular contributions, even small amounts, can accumulate over time and provide a secure financial future.

Tip 5: Seek Professional Financial Advice

If you encounter complex financial situations or require guidance, don't hesitate to consult a qualified financial advisor. They can provide personalized advice, help you develop a tailored financial plan, and optimize your financial strategies.

Tip 6: Enhance Financial Literacy

Continuously educate yourself about personal finance. Read books, attend workshops, or utilize online resources to improve your financial knowledge. Understanding financial concepts and market trends empowers you to make informed decisions.

Tip 7: Monitor Credit Health

Your credit history plays a significant role in financial transactions. Regularly check your credit reports for accuracy and monitor your credit score. Maintaining a good credit score qualifies you for favorable interest rates and improves your overall financial standing.

Tip 8: Plan for Retirement Early

Retirement planning is essential for a secure financial future. Start saving early, even if it's a small amount, to take advantage of compound interest and ensure a comfortable retirement lifestyle.

Effective financial management requires discipline, planning, and ongoing adjustments. By implementing these tips, you can gain control of your finances, achieve your financial goals, and build a secure financial future.

For more comprehensive financial solutions and expert guidance, connect with Citibank: Your Trusted Partner For Comprehensive Financial Solutions.

Citibank: Your Trusted Partner For Comprehensive Financial Solutions

Citibank has established itself as a reliable and comprehensive financial solutions provider, catering to a wide range of financial needs. Its commitment to delivering tailored solutions, innovative products, and exceptional customer service makes it a trusted partner for individuals and businesses alike.

- Personalized Solutions: Customized financial plans designed to meet specific goals and aspirations.

- Innovative Products: Cutting-edge banking and investment products leveraging technology to enhance convenience and efficiency.

- Global Presence: Extensive global network enabling seamless financial transactions and access to international markets.

- Financial Expertise: Seasoned financial professionals providing personalized guidance and expert advice.

- Unwavering Support: Dedicated customer service team offering 24/7 assistance and resolving queries promptly.

- Strong Reputation: Established reputation built on trust, reliability, and a commitment to customer satisfaction.

Citibank's unwavering commitment to innovation and customer-centricity has earned it recognition as a leading global financial institution. By leveraging its expertise and global reach, Citibank empowers individuals and businesses to achieve their financial aspirations and navigate the complexities of the modern financial landscape.

Financial Package - Perfecto ERP Solutions - Source www.perfectoerp.com

Citibank: Your Trusted Partner For Comprehensive Financial Solutions

Citibank's reputation as a trusted partner for comprehensive financial solutions stems from its unwavering commitment to providing clients with a holistic suite of services tailored to their unique needs. By leveraging its global reach, financial expertise, and innovative technology, Citibank empowers individuals and businesses alike to achieve their financial aspirations.

Your Trusted Partner for High-Stakes, Accurate Translations in - Source www.goinggloballive.co.uk

As a trusted partner, Citibank prioritizes building long-term relationships with its clients. This approach enables the bank to gain a deep understanding of their financial goals, risk tolerance, and investment strategies. This intimate knowledge allows Citibank to provide personalized financial advice and tailored solutions that align with each client's specific objectives.

Moreover, Citibank's comprehensive financial solutions encompass a wide range of services, including wealth management, investment banking, commercial banking, and consumer banking. This integrated approach enables clients to access a full spectrum of financial products and services under one roof, ensuring seamless and efficient management of their finances.

Real-life examples abound that showcase the practical significance of Citibank's trusted partnership approach. For instance, Citibank's wealth management services have helped countless individuals build and preserve their wealth, guiding them through market volatility and achieving their long-term financial goals. Additionally, Citibank's investment banking expertise has been instrumental in supporting businesses of all sizes in raising capital, executing mergers and acquisitions, and navigating complex financial transactions.